Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Group】--The Best Gold Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Group】--The Best Gold Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

What Are Gold Stocks?

Gold stocks refer to publicly listed www.xmcnbrokers.companies that are active in the gold sector. They are primarily involved in the exploration, extraction, and refining of gold. The recent adoption of AI has opened the path for services www.xmcnbrokers.companies that use AI to discover deposits. Gold storage www.xmcnbrokers.companies provide an alternative method for indirect gold exposure. Still, investors should focus on exploration, extraction, and refining of gold via established and junior gold miners.

Why Should You Consider Investing in Gold Stocks?

Gold has always held fascination as a wealth and status symbol, but gold stocks also offer numerous practical benefits, and investors should consider adding them to their portfolios. Gold outperforms during economic uncertainty and geopolitical risk events, which adds downside protection to equity portfolios. Gold stocks also offer an inflation hedge and outperform during periods of US Dollar weakness.

Here are a few things to consider when evaluating gold stocks:

- Invest in a www.xmcnbrokers.combination of established gold miners for stability and pidends, and junior miners, which carry greater risks but offer notable upside potential

- Analyze gold reserves of gold miners to gauge the longevity of their operations

- Focus 75% of your portfolio on gold stocks with mining operations in the top ten countries for gold production, with the remaining 25% on exciting global projects

What Are the Downsides of Gold Stocks?

Volatile gold prices pose the most notable risk, as they directly impact the profitability of gold stocks. While the last three years have witnessed high gold prices and all-time highs, which encouraged exploration and higher pidend yields, other periods have seen depressed prices. Long-term, gold is likely to march higher as the current global economic and political landscape faces graver risks than any period in the past seventy years.

Here is a shortlist of attractive gold stocks:

Caledonia Mining Corporation (CMCL) Idaho Strategic Resources (IDR) Newmont Corporation (NEM) SSR Mining (SSRM) New Gold (NGD) McEwen Mining (MUX) AngloGold Ashanti (AU) Coeur Mining (CDE) Kinross Gold (KGC) Gold Fields (GFI) Royal Gold (RGLD) Hecla Mining (HL) DRDGold (DRD) Contango Ore (CTGO) Seabridge Gold (SA)

Caledonia Mining Corporation Fundamental Analysis

Caledonia Mining Corporation (CMCL) owns a 64% stake in the gold-producing Blanket Mine, and 100% stakes in the Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims, all located in Zimbabwe. The Blanket Mine produces 75,000 to 80,000 ounces of gold annually.

So, why am I bullish on CMCL after its 50%+ rally?

The current annual output with gold at record highs offers an excellent free cash flow that CMCL can reinvest in its Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims. Caledonia Mining Corporation has outstanding returns on assets, equity, and invested capital. Its profit margins also rank among the best in the industry. Its latest earnings report featured record-breaking production numbers, valuations are cheap, and the pidend yield is a bonus for investors.

Caledonia Mining Corporation Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 14.80 makes CMCL an inexpensive stock. By www.xmcnbrokers.comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for CMCL is 27.50. It suggests no upside potential based on analyst estimates, but I expect upward revisions following its blockbuster earnings report.

Caledonia Mining Corporation Technical Analysis

- The CMCL D1 chart shows price action breaking out above its ascending 0.0% Fibonacci Retracement Fan level

- It also shows Caledonia Mining Corporation pushing above the upper band of its bullish price channel with increased upside momentum

- The Bull Bear Power Indicator has been bullish for over four weeks

My Call

I am taking a long position in CMCL between 26.70 and 28.54. Caledonia Mining Corporation reported a blockbuster quarter; gold prices are likely to push higher, and valuations remain cheap for this junior miner. The bullish trading volumes and momentum suggest more upside.

AngloGold Ashanti Fundamental Analysis

AngloGold Ashanti (AU) is a global gold mining www.xmcnbrokers.company with eleven operations in Argentina, Australia, Brazil, the Democratic Republic of the Congo (DRC), Egypt, Ghana, Guinea, and Tanzania. It also has greenfield projects in Colombia and the US, as well as greenfield exploration in Argentina, Australia, Brazil, Egypt, Tanzania, and the US. It is the 7th largest gold miner based on 2023 production.

So, why am I bullish on AngloGold Ashanti after its 140%+ rally in 2025?

I like the AU acquisition of Egyptian gold producer Centamin, as it boosted reserves and production potential thanks to the large-scale, long-life, world-class Tier 1 Sukari mine and its 500,000 ounces annualized production capacity. Gold production for AU surged 21% year-over-year to 804,000 ounces in the second quarter of 2025. Valuations are attractive, and AngloGold Ashanti boasts superb operating statistics that should propel its share price higher.

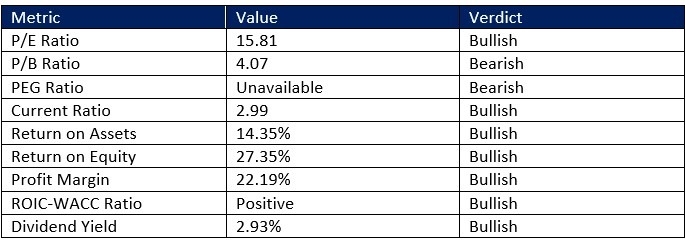

AngloGold Ashanti Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 15.81 makes AU an inexpensive stock. By www.xmcnbrokers.comparison, the P/E ratio for the S&P 500 is 29.07.

The average analyst price target for AngloGold Ashanti is 54.17. It suggests no upside potential based on analyst estimates, but I expect upward revisions following its latest production data.

AngloGold Ashanti Technical Analysis

- The AU D1 chart shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan

- It also shows AngloGold Ashanti inside a bullish price channel

- The Bull Bear Power Indicator has been mostly bullish since the second week of August with an ascending trendline

My Call

I am taking a long position in AngloGold Ashanti between 58.83 and 60.36. AU is an excellent pidend stock, and it has significantly improved its annualized production capacity while adding to its reserves. I also like the persification of its operations and see more upside ahead.

The above content is all about "【XM Group】--The Best Gold Stocks to Buy Now", which is carefully www.xmcnbrokers.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Review】--AUD/CHF Forecast: Bounces from Key Support

- 【XM Market Review】--GBP/USD Forex Signal: On the Verge of a Bearish Breakdown

- 【XM Group】--GBP/JPY Forecast: Struggles Amid Central Bank Divergence

- 【XM Market Analysis】--USD/PHP Forex Signal: Philippine Peso Challenges Dollar in

- 【XM Group】--NZD/USD Analysis: Slide Followed By Holiday Sideways Price Interplay